Imagine that a stock with a price of $200 has an annual dividend of $5 per share. A company that pays $1 per share, quarterly, has an annual dividend rate of $4 per share. But bear in mind that a stock’s dividend yield will tend to fluctuate because it’s based on the stock’s price, which rises and falls.

Pros of dividend yields

Dividend yield is one way for long-term investors to decide if a stock is worth buying. Use the MarketBeat dividend yield calculator to evaluate the dividend yields for different stocks. The other, more important, implication when reinvesting is that dividends are compounding, meaning they are added back to the initial invested amount. In simple terms, it means that if you use your dividends to buy even more shares, you will receive a greater amount the next time your dividend pays out because you have more shares, and so on. This allows us to calculate dividends by using the mathematics already set out when calculating compound interest. The dividend yield shown on many popular financial websites can also be misleading.

Dividend Payout Ratio (DPR)

A company with a relatively low DPR is paying dividends, while still investing heavily in the growth of its business. If a company’s DPR is rising, that’s a sign the company’s leadership likely sees more value in rewarding shareholders than in expanding. If its DPR is shrinking, it’s a sign that management sees an abundance of new opportunities abounding. In extreme cases, where a company’s DPR is 100% or higher, it’s unlikely that the company will be around for much longer. Some of the best dividend paying stocks are more established companies in industries like telecommunications, utilities, consumer staples, energy and real estate. The formula for calculating the dividend yield is equal to the dividend per share (DPS) divided by the current share price.

- Company-specific factors such as its stage in its lifecycle, growth opportunities, and shareholder base are all examples of key considerations.

- It is a debatable statement that high dividends come at the cost of the firm’s growth potential.

- Investors can calculate the annual dividend of a given company by looking at its annual report, or its quarterly report, finding the dividend payout per quarter, and multiplying that number by four.

- It’s important for investors to keep in mind that dividend yields are in constant flux.

- The thing about stocks is that they can vary greatly in value – some may cost a couple of dollars while others reach prices in the hundreds.

Dividend Yields and Inflation

For example, if a company pays out $5 dividends quarterly, and you own 20 shares in this company, you will receive $100 in dividends quarterly. The biggest problem with dividend yield is when investors misuse it or rely on it entirely to make their decisions about which stocks to buy and which to ignore. A higher yield doesn’t matter if there are risks to the company that pays the dividend. AT&T struggled under billions in debt from multiple acquisitions that went badly, and investors have paid the price. This is often the case with young or rapidly growing companies that opt to reinvest their profits back into the business. The most recent dividend can also be used and multiplied by the number of times the dividend is paid out per year.

In a situation where the future dividends are not predictable, this method of yield determination can be relatively useful as a measurement of value. For example, if you own $20,000 of stock of a company with an annual dividend yield of 5%, you would receive $1,000 in dividend payments for the year. Dividend yield concerns how much an investor realizes from their investments over the course of a year as a result of dividends. Dividends, which are payouts to investors as a share of a company’s overall profit, can help investors generate bigger returns, and some investors even formulate entire strategies around maximizing dividends. For this reason, investors might want to make sure that the company’s dividend yield has maintained a steady trajectory over the past few years.

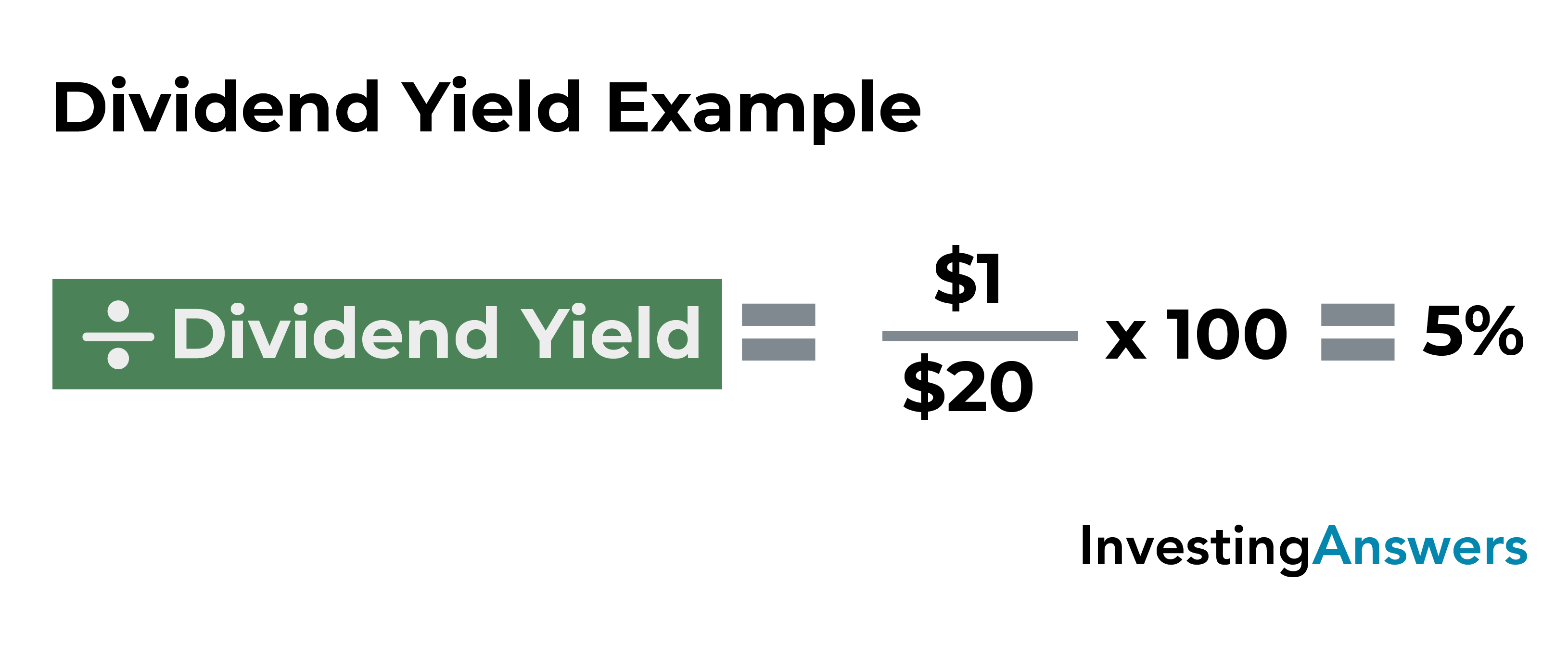

It increases the amount of principal on which you’re earning returns without investing any more additional money. But companies earlier in their lifecycle experiencing high growth – assuming the company is profitable – tend to reinvest their earnings for further growth instead of issuing dividends. On the topic of what a “good” dividend yield is, the answer is entirely contextual. Company-specific factors such as its stage in its lifecycle, growth opportunities, and shareholder base are all examples of key considerations. This means Company A’s dividend yield is 5% ($1 ÷ $20), while Company B’s dividend yield is only 2.5% ($1 ÷ $40).

Note that any historical statistics about dividends may not be reflective of dividends in the future. Dividends can be issued in various forms, including cash payments, additional shares of stock, or other property. The most common form is cash dividends which is what this article focuses on. Because dividend residential yield heavily depends on a company’s stock price, a rapid fall (or rise) in prices can distort the story the numbers tell. There are many complicated calculations that investors have to make, but the dividend yield is pretty simple to calculate using public data sources or tools provided by your brokerage.

For example, if a given stock—trading at $125 per share—pays a quarterly dividend of 75 cents per share, this means the stock’s annual dividend is $3 per share. To discover the stock’s dividend yield, divide the $3 annual dividend by $125. If a company’s dividend yield has been steadily increasing over time, such changes could be interpreted positively if caused by an increasing dividend payout.

High dividend yield stocks indicate how much a firm pays out in dividends about its market share price each year. It is a way to measure the cash flow ploughed back for every amount invested in the equity position. As there is no accurate capital gains information available, this yield on dividend acts as a potential return on investment for a given stock. Investors who target having a minimum cash inflow from their investment portfolio can ensure this by making investments in stocks that regularly pay relatively high and stable dividend yields. It is a debatable statement that high dividends come at the cost of the firm’s growth potential.

This makes it easier to see how much return the shareholder can expect to receive per dollar they have invested. If a company returns a big percentage of its profits in dividends — one common threshold is 80% — some investors may view that as a warning sign about the long-term viability of those payouts. If you’re more interested in long-term growth than shorter-term income from your investments, dividends may not be so significant to you. However, it is worth noting that companies’ dividend decisions can affect their stock price — and therefore, your portfolio. The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Because of how dividend yield is calculated, the yield is higher as the stock price falls, so it’s important to evaluate whether there has been a downward price trend. Often, when a company is in trouble, one of the first things it is likely to reduce or eliminate is that dividend. A dividend can be understood as a payment made by a company to its shareholders as a form of return for investing in the business. The dividends are usually sourced from the net income, so the more profitable the company, the more sustainable its dividends are. The dividend yield of Company A and Company B can be determined by dividing the current share price by the dividend per share (DPS) in each period.